How Much Would Every American Need to Pay to Erase the Nation’s $36.2 Trillion Debt?

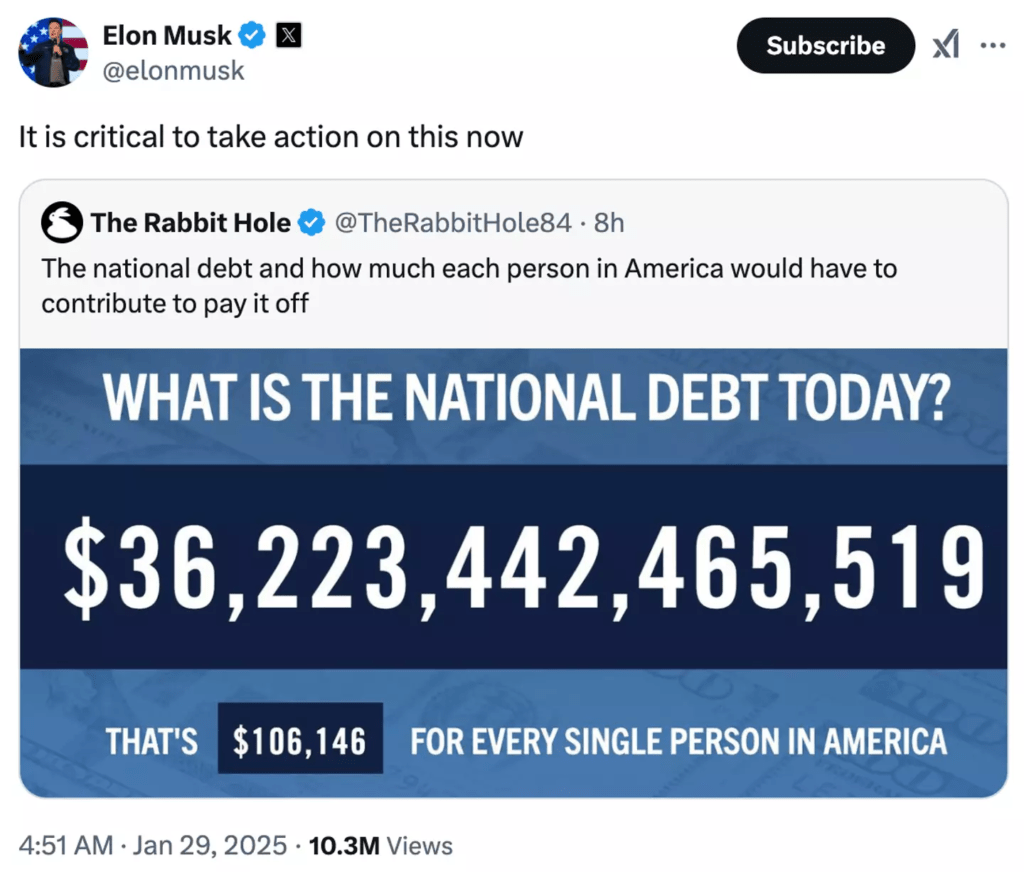

America’s national debt is a staggering figure—$36.2 trillion as of January 29, 2025—and it’s growing by the second. If the country wanted to pay it off, every person in the United States would need to contribute an eye-watering amount. As the debt continues to accumulate, it’s becoming clear that a few good Samaritans won’t be enough to resolve the issue. In fact, solving this debt crisis would require a significant financial commitment from every citizen.

Let’s break down just how much this debt costs, why it’s so large, and what the future holds for America’s financial stability. In this article, we’ll take a closer look at the numbers, the causes, and what steps can be taken to manage the debt in the long run. Along the way, we’ll also explore the social media reactions to the ongoing crisis and how the situation is resonating with everyday Americans.

The Nation’s National Debt: A Constantly Rising Number

Tracking the nation’s debt is no easy task, as it’s constantly shifting. In fact, the Peter G. Peterson Foundation, a nonpartisan organization dedicated to promoting fiscal responsibility, offers a live debt tracker that updates in real time, showing exactly how much the U.S. owes at any given moment. As of January 29, 2025, this debt stands at an astronomical $36.2 trillion—an amount that is difficult to grasp, but one that every citizen would be impacted by.

To put this number in perspective, let’s break down what that $36.2 trillion debt would mean for each American. According to the Foundation’s tracker, every individual in the U.S. would need to pay approximately $106,136 to erase the nation’s debt. This amount far exceeds the average annual salary for many Americans, making it clear just how unsustainable the current debt load is.

If you want to track the nation’s debt in real time, you can visit the Peter G. Peterson Foundation’s Debt Tracker.

Why Is the National Debt So High?

The root of the national debt lies in an imbalance between government spending and the revenues it collects. Simply put, the U.S. government spends more money than it takes in through taxes and other revenue sources, leading to a budget deficit that must be covered by borrowing. This borrowing results in the growing national debt.

Several factors contribute to this deficit:

- Increased Spending on National Emergencies: Throughout history, the U.S. has borrowed heavily to finance national emergencies such as wars or economic downturns like the Great Depression. For example, defense spending and war-related costs have historically added to the nation’s debt.

- Rising Healthcare Costs: As healthcare expenses continue to rise, particularly with an aging population, the government is forced to allocate more funds to Medicare, Medicaid, and other health-related programs. This is a significant factor contributing to the ballooning deficit.

- A Tax System That Isn’t Bringing in Enough Revenue: The U.S. tax system, as it currently stands, does not generate enough revenue to cover the government’s spending obligations. The Peter G. Peterson Foundation explains that this imbalance between revenue and expenditure has led to a growing deficit and, subsequently, an increasing national debt.

For a more in-depth look at the history of the U.S. tax system and its impact on the national debt, you can explore this comprehensive analysis by the Tax Foundation.

What Would It Take to Pay Off the Debt?

To pay off the current debt, every single person in the U.S. would need to contribute approximately $106,136. This amount varies depending on the number of people in the U.S. and fluctuating interest rates, but the sheer scale of the debt makes it clear that such a solution is unrealistic.

Even the world’s wealthiest individuals, like Elon Musk, wouldn’t be able to cover the debt, despite their billions. For example, Musk’s net worth is estimated to be around $417.4 billion, which would only cover a small portion of the nation’s $36.2 trillion debt. The reality is, it would take a collective effort from every American to tackle this crisis, and even then, the financial burden would be extraordinary.

Elon Musk recently weighed in on the issue after the Foundation’s debt tracker was shared on Twitter, calling it “critical” that action is taken to address the mounting debt. He’s not the only one concerned. Many Americans are alarmed by the growing deficit and the financial implications it could have on future generations.

Social Media Reacts to America’s Debt Crisis

On social media, the scale of the national debt has left many users in disbelief. Twitter users have expressed shock, with one user commenting, “That’s crazy! Cut the spending immediately.” Another simply added, “That’s so much debt.” These comments highlight the frustration and concern many Americans feel about the debt crisis and its potential impact on their lives.

It’s not just the general public who are concerned—economists, financial analysts, and public figures have all voiced their worries about the future. If you’re interested in how influential voices like Elon Musk are talking about this issue, you can follow him on Twitter.

Interest on the Debt: A Growing Problem

One of the most alarming aspects of the national debt is the interest it generates. The U.S. government spends an eye-watering $1.8 billion each day just on interest payments alone. Over time, this amount will only increase. The Peter G. Peterson Foundation estimates that the interest payments will “more than double” within the next 10 years if current trends continue. This adds a layer of urgency to the situation, as it means the debt is growing exponentially even if no new borrowing takes place.

If you’re interested in learning more about how interest on the national debt is calculated and its long-term impact, check out this detailed breakdown from the National Debt Clock.

What Can Be Done About the Debt?

While the national debt is a complex issue with no easy solution, there are potential ways to reduce it over time. Some key actions that could help include:

- Reforming the Tax System: Adjusting the tax code to bring in more revenue could help address the imbalance between spending and income. This might involve closing loopholes, increasing tax rates for higher earners, or creating new revenue sources.

- Cutting Government Spending: Reducing federal spending, especially on discretionary programs, could help lower the annual deficit. However, this is often politically challenging, as many government programs are deeply entrenched and serve a wide range of needs.

- Reducing Healthcare Costs: Addressing the rising costs of healthcare could significantly reduce the financial burden on the government and help lower the debt.

The Path Forward

The United States faces a monumental challenge in addressing its national debt. It’s clear that the current trajectory is unsustainable, and if the government doesn’t take action, the consequences could be severe for future generations. While it’s unlikely that a single person or group can fix the problem, every American has a role to play in advocating for fiscal responsibility.

In the end, the solution will require bipartisan cooperation, long-term planning, and difficult decisions. For now, Americans will continue to watch the debt tracker tick upward, hoping that their leaders will take the necessary steps to rein it in before it spirals even further out of control.

Engage with the Conversation

How do you feel about America’s national debt? Do you think the government should focus more on cutting spending or reforming taxes? Share your thoughts on social media using the hashtag #FixTheDebt and join the conversation today.

For more information on this issue and other important financial topics, follow our blog.

Featured Image Credit: Getty Images/Photo by Supoj Buranaprapapong