Get Ready for the Next Big Move: Michael Saylor Hints at Microstrategy’s Bold Bitcoin Plan!

Michael Saylor’s Microstrategy has built a bitcoin empire, holding 450,000 BTC, a move that’s paid off handsomely. Over the past six months, its stock has surged 152%, with a 27.92% jump in just five days. Since 2020, Saylor’s firm has invested $28.179 billion in BTC, using debt to fuel acquisitions. As of January 19, 2025, those holdings have skyrocketed in value by $19.055 billion, now worth $47.234 billion. The firm’s strategy outperformed alternatives like Ethereum, showing a 68% gain. Saylor’s bold vision for bitcoin continues to reshape the corporate landscape, positioning Microstrategy as a pioneer in the digital revolution.

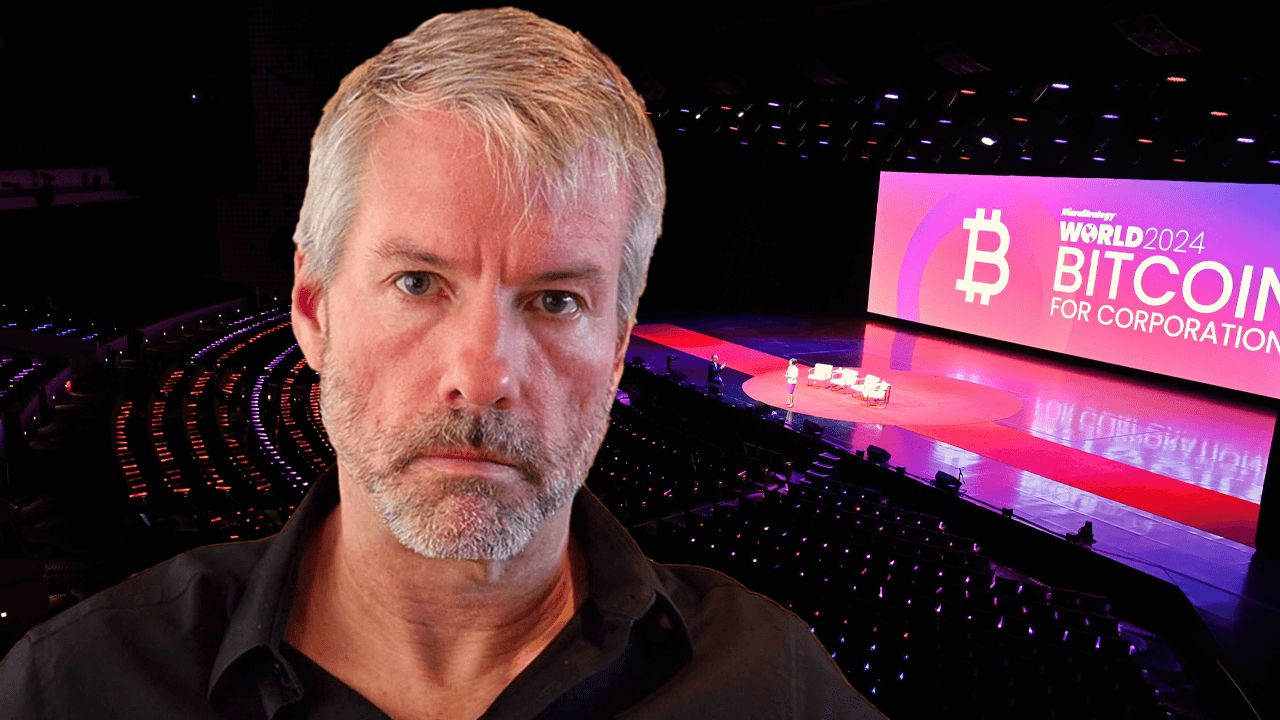

In the world of corporate finance, few stories have captured attention like that of Michael Saylor and his company, Microstrategy. What began as a business intelligence firm has transformed into a powerful player in the cryptocurrency space, thanks to an audacious bet on bitcoin. Since 2020, Saylor has guided the firm through a calculated strategy of acquiring vast amounts of BTC, positioning Microstrategy as a leader in the digital asset revolution. As bitcoin continues to soar in value, Microstrategy’s remarkable growth serves as both a case study in financial innovation and a testament to Saylor’s unwavering confidence in the future of cryptocurrency.

The Rise of Microstrategy: A Bitcoin Empire in the Making

Michael Saylor’s Microstrategy has defied the odds to emerge as one of the most influential forces in the cryptocurrency market. What started as a conventional business intelligence firm has now become a symbol of bold innovation, fueled by an unwavering belief in bitcoin’s potential. Since 2020, Saylor’s firm has meticulously amassed 450,000 BTC, investing $28.179 billion through a mix of strategic acquisitions and leveraged debt. This calculated approach has paid off spectacularly, with the value of its holdings soaring by 68%—an increase of $19.055 billion, bringing the total value of Microstrategy’s bitcoin reserves to a staggering $47.234 billion by January 2025.

Unprecedented Financial Growth: A Stock Surge to Match

The financial results speak for themselves. Microstrategy’s stock has surged an extraordinary 152% in the past six months alone, with an eye-popping 27.92% jump just in the last week. These impressive gains reflect the market’s increasing confidence in Saylor’s strategy and the company’s commitment to bitcoin. While other companies in the market have hesitated to fully embrace cryptocurrency, Microstrategy’s unrelenting focus on bitcoin has set it apart as a corporate pioneer.

Michael Saylor’s Microstrategy transformed into a bitcoin powerhouse, holding 450,000 BTC worth $47.234 billion, with a 68% gain. This bold strategy reshaped corporate finance, establishing Microstrategy as a leader in the digital asset revolution.

The Rise of Microstrategy: A Bitcoin Empire in the Making

Michael Saylor’s Microstrategy has become a major force in the cryptocurrency market, evolving from a traditional business intelligence firm to a bitcoin powerhouse. Since 2020, the company has amassed 450,000 BTC, investing $28.179 billion using strategic acquisitions and debt. This has resulted in a 68% increase in value, with a $19.055 billion rise, bringing Microstrategy’s bitcoin holdings to $47.234 billion by January 2025.

Unprecedented Financial Growth: A Stock Surge to Match

Microstrategy’s stock has surged 152% in the past six months, with a 27.92% jump in just five days. This reflects growing market confidence in Saylor’s bitcoin strategy, setting the company apart as a corporate pioneer.

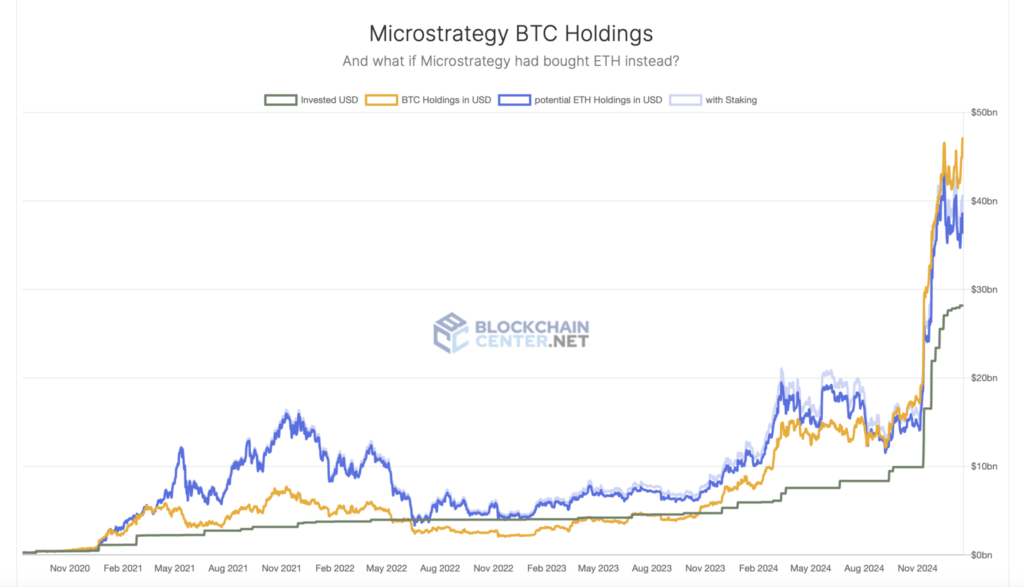

Bitcoin vs. Ether: The Winning Bet

Michael Saylor bet on bitcoin has paid off, outperforming Ethereum with a 68% gain compared to ETH’s 33%. This decision reinforces Saylor’s belief in bitcoin’s long-term potential, positioning Microstrategy for continued success in the digital asset world.

A Visionary Leader and Bold Strategy

Michael Saylor’s bold vision has transformed Microstrategy into a leader in the digital revolution. By embracing bitcoin, the company is reshaping corporate finance and serving as a case study in innovation, risk-taking, and long-term strategy.

A Bold Bet, A Winning Strategy

Saylor’s unwavering belief in bitcoin has positioned Microstrategy as a trailblazer in the digital asset space. With soaring stock prices and bitcoin holdings, the verdict is clear: his bold bet was brilliant, paving the way for future success.

Bitcoin vs. Ether: The Winning Bet

If Saylor had opted to invest in Ethereum (ETH) instead of bitcoin, the returns would have been far less impressive. With bitcoin’s 68% gain outpacing ether’s 33%, Microstrategy’s position in the digital asset world has proven to be a smarter, more lucrative move. This decision highlights the conviction Saylor has in bitcoin’s supremacy over other cryptocurrencies and showcases how his firm is positioning itself for long-term success.

A Visionary Leader and a Transformative Strategy

At the heart of this remarkable story is Michael Saylor’s bold vision for Microstrategy’s future. His unwavering faith in bitcoin has transformed the firm into a leading force in the digital revolution. Microstrategy is not just riding the wave of success; it’s creating the future of corporate finance. As the company’s valuation continues to soar, it serves as a powerful case study for other businesses on how innovation, risk, and long-term strategy can reshape entire industries.

A Bold Bet, A Winning Strategy

Microstrategy’s story is a testament to the power of visionary leadership and the potential of cryptocurrency to transform corporate finance. By embracing bitcoin, Saylor has positioned Microstrategy as a trailblazer in the digital asset space, with a strategy that has already paid off handsomely. With the company’s stock and bitcoin holdings continuing to rise, the verdict is clear: Saylor’s bet on bitcoin was not only bold but brilliant, setting the stage for continued success in the years ahead.

How much further could Microstrategy’s bitcoin empire grow as the cryptocurrency market continues to evolve?